The case for embracing a higher CAC

Growth minded companies should stop obsessing about CAC reduction. Here's what to do instead.

For as long as I can remember, customer acquisition cost (CAC) has been treated as the enemy.

A villain to be defeated. A metric that must be optimized at all costs.

And it makes sense. Only if you’re in a bad spot.

If your payback period is stretched to oblivion, your margins are thin, and profitability feels like a distant dream, then yes, reducing CAC is a survival tactic.

But there's the other side of the coin that's never talked about.

And that's voluntarily increasing your CAC and being okay with it.

What I cover in this article:

- Higher CAC isn't a problem. It's a competitive advantage

- The real metric to watch: It's not CAC

- How to position your company to afford a high CAC?

- The catch: When higher CAC doesn’t work

- The shift: Thinking like a market leader

- Final thoughts: Opportunity in being comfortable with a higher CAC

Higher CAC isn’t a problem. It’s a competitive advantage

The best companies position themselves to afford a higher CAC. They see it as an investment in outpacing competitors and capturing more market share.

Let’s break this down.

When you’re able to acquire customers at a higher CAC than your competitors, a few things happen:

- You can bid more aggressively and win more deals. Competitors optimizing for lower CAC will find themselves priced out of key channels, unable to compete on ad spend, sales incentives, or outbound efforts.

- You capture market share faster. If you’re playing the “lower CAC” game, you’re likely constrained by budget and efficiency thresholds. Meanwhile, the companies willing to spend more are scooping up customers while you deliberate.

- You build a durable moat. A company that can sustainably acquire customers at a higher CAC has more fuel for growth. That means, more revenue, more data, and more brand presence. Ultimately, creating a compounding advantage over time.

Trying to reduce CAC is often a defensive strategy. It means you’re already in a position where you need to do it.

The real metric to watch: Payback period, not CAC

If there’s one major flaw in the “reduce CAC” mindset, it’s that it ignores payback periods.

High CAC isn’t a problem if your payback period is reasonable.

In fact, if you can profitably sustain a higher CAC while keeping payback periods within an acceptable range (this varies from one company to another depending on your industry and GTM motion), then you’re leaving money on the table by not spending more.

At companies with strong product-market fit, where customers are sticking around and expanding their accounts, the real question isn’t, “How do we lower CAC?”.

But rather, “How fast can we recover it?”

How to position your company to afford a high CAC?

Winning companies do not just accept a high CAC. They engineer their go-to-market motion to make it work.

This is my playbook to position a company to afford a higher CAC and turn it into a long-term competitive advantage.

Step 1: Identify and dominate your best segments

Most companies have one or two customer segments where they are highly profitable.

The worst thing you can do instead of doubling down is spreading yourself too thin by going after multiple segments.

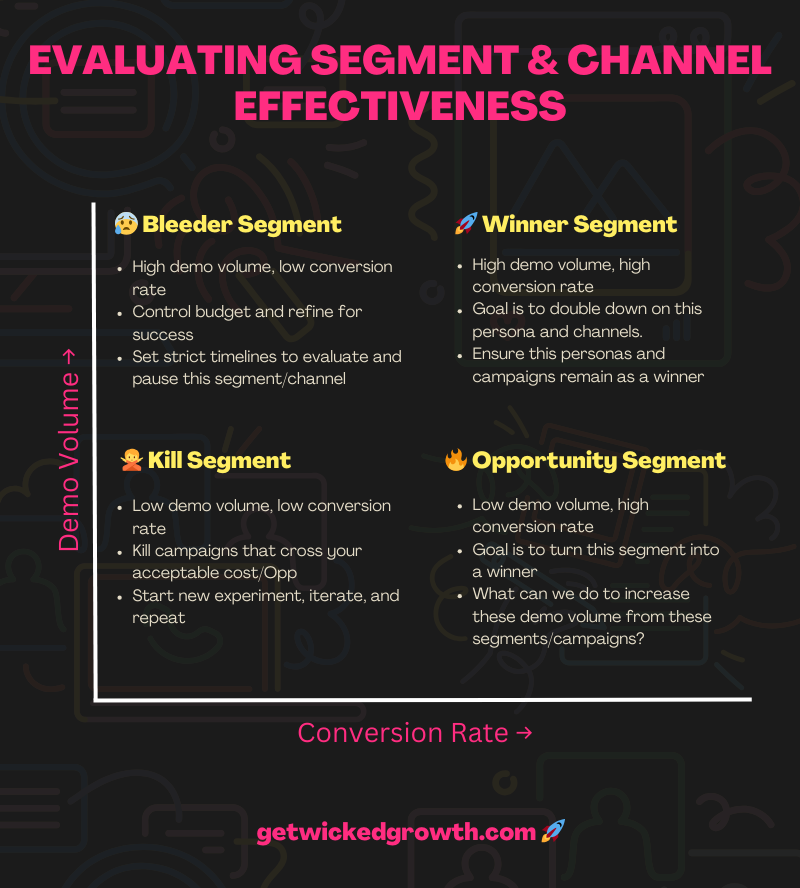

But how do you identify your best segments?

- Analyze closed-won deals from the past 12 to 18 months to find the segments that drive the most revenue, highest retention, and best expansion potential. Look at:

- Company size (SMB, mid-market, enterprise)

- Industry (which verticals convert best)

- Titles and departments (who are the strongest buyers)

- Deal size and payback period (which segments make CAC investment worthwhile)

- Compare this against closed-lost deals to identify weak points.

- Where do deals stall?

- Which industries have high demo volume but low conversion rates?

- Are you wasting budget on segments that do not close?

* The AND part is super important. A lot of times the most loudest ones aren't necessarily your best fit prospects/customers.

For example:

A B2B SaaS company might find that VP of Marketing at mid-market companies with 200 to 500 employees close the fastest, expand over time, and have the lowest churn.

If that is the most profitable segment, the goal should be to fully dominate that market before expanding elsewhere.

I've written in detail about how to find your best segments of customers over here 👇

Step 2: Use market & competitor's conditions to your advantage

This is where a really great PMM can show their real potential.

There’s a famous quote by Winston Churchill that I love and I think it’s applicable here:

“Never let a good crisis go to waste”

A competitor’s funding status, layoffs, or internal struggles present an opportunity to capture market share.

If a competitor is in cost-cutting mode while your company has just raised funding, you have more room to be aggressive while they are playing defense. But to really make this count, I can't stress enough on how important it is to nail step 1.

Tactical plays to exploit market weaknesses

- Lower prices for key accounts

- Identify a competitor’s top customers and offer them exclusive pricing to make switching easier. On the flip side, you can also find a segment of the market that the leading player in the industry is actively ignoring and use that to your advantage.

- Avoid devaluing the product. Frame it as an investment in their business rather than a discount war.

- Buy out contracts

- Offer to pay off early termination fees for customers who switch to your platform.

- This removes a major barrier to switching providers.

- Provide white-glove migration and onboarding

- Most companies hesitate to switch tools due to the effort required. Solve this by:

- Offering full-service data migration with no manual work required from the customer.

- Setting up processes for them within your platform instead of leaving it to the customer.

- Assigning a dedicated onboarding specialist to ensure a smooth transition. The key is that this person is truly invested in the success of your customer with your product and knows your product inside out (much like the founder).

- Most companies hesitate to switch tools due to the effort required. Solve this by:

- Let them start with a monthly plan before pushing for an annual plan upgrade

- When switching, don't force your prospects into an annual plan. No matter how much your investors are pushing for it.

- Start your prospects on a monthly plan while they're switching from a competitor. Make the onboarding period free. Win their trust during the onboarding phase with an unbelievably solid support and onboarding. Of course, the product still has to do it's job.

For example

If a competitor has recently announced layoffs, their customer success and support teams are stretched thin. Their customers are likely feeling neglected. This is the perfect time to launch a campaign emphasizing that your team will handle migration, optimize setup, and fully onboard new customers within a week.

The objective is to position your company as the safer, more stable, and more proactive alternative while competitors struggle.

Step 3: Track the right metrics to justify a higher CAC

If you are spending more per customer, it is critical to track the right key performance indicators to ensure the investment is paying off.

The goal is not just to acquire customers at any cost, but to increase the acceptable CAC threshold by maintaining higher conversion rates and a faster payback period.

Key metrics to track

- Acceptable Cost Per Qualified Demo

- The key question is whether these demos are converting at a high enough rate to justify the spend.

- The key question is whether these demos are converting at a high enough rate to justify the spend.

- MQL to SQL to Closed-Won Conversion Rate

- A higher CAC must correlate with an efficient sales process.

- If demo volume increases but closed deals do not, the focus should be on improving qualification and nurturing strategies.

- Marketing teams often look at MQLs and Cost/MQLs. In this case, it's super important to also look at what percentage of MQLs turn into customers? Because this directly impacts your acceptable cost per MQL and using it as a leading indicator.

- Payback Period and Expansion Revenue

- A higher CAC is justified if customers stick around, switch to annual plans, and begin expanding their accounts, and eventually have long retention.

- Tracking time-to-upgrade and expansion revenue growth will help ensure sustained profitability.

For example:

If the current CAC payback period is three months, the company can safely increase CAC to capture more market share as long as conversion rates remain steady.

The goal is to ensure you're constantly getting folks into your ecosystem and that they fall under the "Winner Segment" every single time.

Step 4: Invest in multi-channel visibility to outcompete competitors

Once the right segments and metrics are established, the next step is to scale visibility so that the target audience sees the company everywhere.

This strategy is not just about running ads. It is about creating a surround-sound effect where the ideal customer profile repeatedly encounters your brand.

Where to invest to outcompete your competitors

- Bid aggressively for the best segments

- Target this segment of your TAM with high-bid strategies across:

- Google Search and Bing Ads for high-intent leads

- LinkedIn Ads for precise B2B targeting

- LinkedIn, Meta, and YouTube Ads for retargeting and staying top of mind

- Target this segment of your TAM with high-bid strategies across:

- Sponsor industry-specific content channels

- Invest in newsletters, podcasts, and event sponsorships where target buyers are actively engaged. The goal is to associate your brand with a thought leader who has gained tremendous respect from the market and ultimately build trust for your brand through association.

- Prioritize thought leadership and presence in communities where buyers seek recommendations.

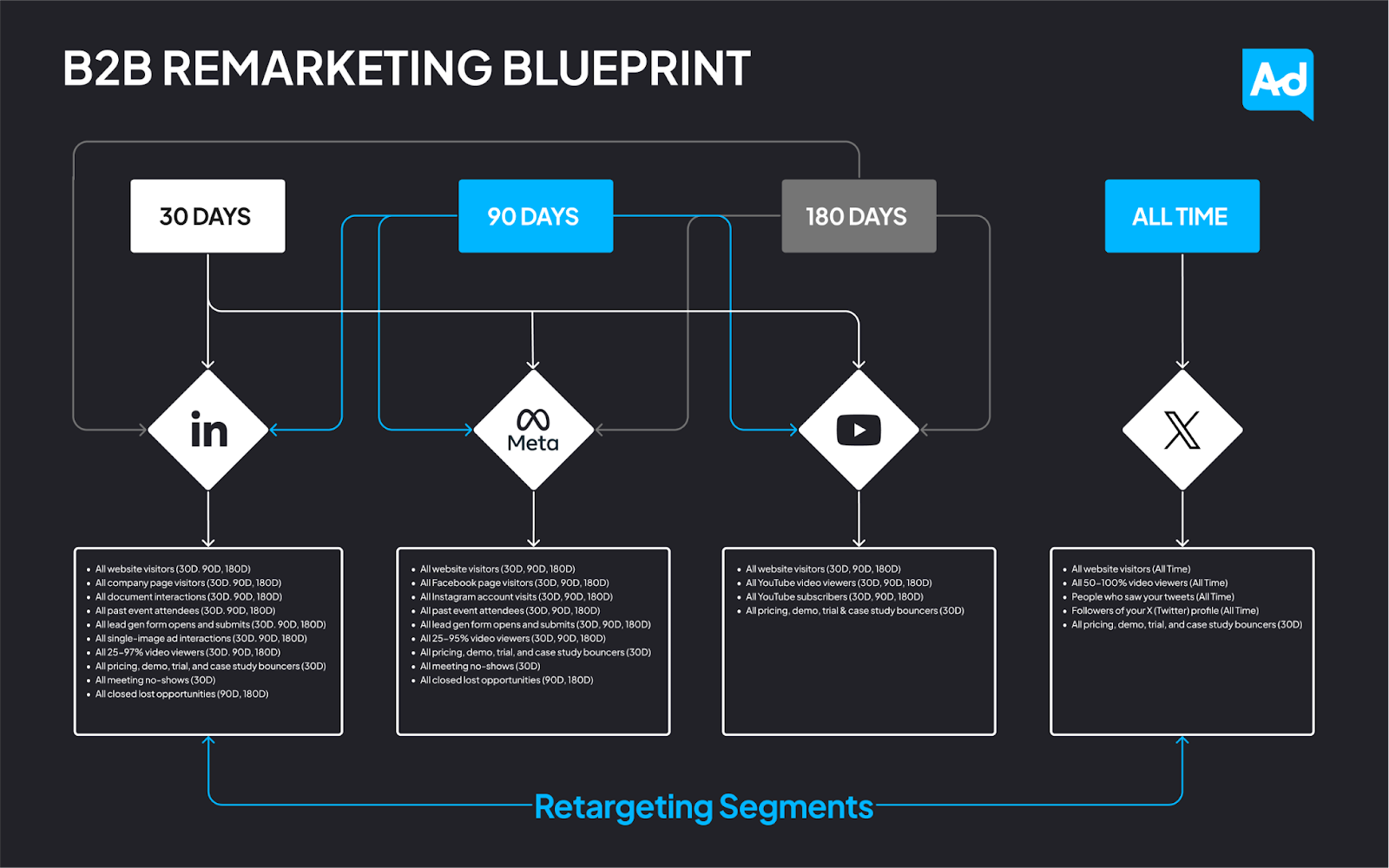

- Deploy a surround sound retargeting strategy

- Retarget website visitors across LinkedIn, YouTube, and Meta to maintain top-of-mind awareness.

- AdConversion has a detailed blueprint on multi-channel retargeting, which in my opinion is one of the most comprehensive approaches with each campaign in each channel with its own timeline. This makes pacing, optimization, and reporting really easy.

For example:

If revenue operations leaders at mid-market companies are the top target, the objective should be to ensure they see the brand daily. On LinkedIn, in newsletters, in Google search results, and in industry-specific content.

A well-executed strategy will create a situation where the target buyer feels like the company is everywhere.

The catch: When higher CAC does NOT work

Now, to be fair, there are some scenarios where a high CAC strategy falls apart:

- Weak retention and expansion. If your churn is high and customers aren’t growing their accounts, a high CAC is a death sentence. You need to fix your product, onboarding, or customer success before even thinking about scaling spend.

- Long, unpredictable payback periods. If it takes 24+ months to recover CAC, you’re playing a dangerous cash flow game. Investors might stomach that if you’re a category-defining company, but most businesses can’t afford to.

- Low-margin businesses. If your margins are razor-thin, you might not have the flexibility to support high CAC. Businesses that thrive on high CAC tend to have strong LTV and expansion potential.

But if you’re in a position where your customers are sticking, and your payback period is manageable?

You’re playing too small if you’re fixated on CAC reduction.

The shift: Thinking like a market leader

Most companies optimize CAC like they’re struggling to survive. The best companies approach it like they’re building an empire.

Instead of asking, “How do we reduce CAC?” ask:

- How do we increase our conversion rates to justify higher spend?

- How do we shorten our payback period so we can afford to be aggressive?

- How do we structure our pricing, packaging, and expansion revenue to maximize LTV?

Winning companies don’t obsess over spending less to acquire customers. They focus on spending as much as possible — profitably — to win the market faster.

Final thoughts: The opportunity in being comfortable with a higher CAC

The business landscape is shifting.

Ads are getting more expensive. Attention is harder to capture. Demand generation is increasingly becoming pay-to-play.

Companies that accept these realities and structure themselves to thrive despite them will win. Those that cling to viewing CAC in a single dimension with an outdated obsession towards lowering it will find themselves outspent, outmaneuvered, and ultimately, out of the game.

So ask yourself: Is your company positioning itself to survive or to dominate?

If it’s the latter, stop fearing CAC.

Start owning it.

Big thanks to Sharan Suresh, Sam Kuehnle, and Shri Mithran for listening to me ramble about this and helping me structure my thoughts.