Market segmentation in B2B: Here’s how I segment to win more customers. Template included

Segmentation is how you win in an increasingly competitive market in B2B. Here's my step-by-step process. Template included at the bottom of this article for subscribers.

I almost didn’t write this post because, let’s be honest, the topic of “market segmentation” can sound either painfully obvious or impossibly tedious.

It’s often treated as a last resort for struggling businesses or a buzzword for marketers. But what if it’s actually your fastest path to scaling effectively?

For early-stage startups, finding your niche can feel like squeezing yourself into a box. For later-stage companies, it’s often deprioritized because “expanding the market” feels more exciting than “shrinking the focus”.

And so, we’re stuck doing a little bit of everything, hoping something sticks. Sound familiar? This leads to scattered resources, inconsistent messaging, and a lot of random acts of marketing that barely move the needle.

But niching down isn’t just about cutting things off; it’s about zooming in on what works best.

Segmenting your market is about being able to confidently say, “This is who we are, this is who we serve, and this is why they choose us”.

Done right, it’s liberating—even fun. You’re not limiting growth; you’re amplifying it. And this process? It’s not just strategic. It’s empowering.

So, if you’ve ever felt paralyzed by too many possibilities or frustrated that your efforts aren’t yielding big wins, this guide is for you.

Let’s dive in.

Step 1: Pull All Contacts Who Requested A Demo From Your CRM

For me, every journey starts with a map. My CRM became that map, and the demo requests? They were the treasure.

They represented proof that someone found enough value in my marketing efforts to take the next step. But extracting insights from those requests wasn’t as simple as I first thought.

Step 1.1: Gather The Right Data

Go into your CRM and pull every closed-won deal, ensuring you include:

- Contact details: Names, job titles, departments, and seniority levels.

- Company information: Employee count, industry, and location.

- Deal metrics (If deal is created): Deal amount, cycle time, and ACV (average contract value).

- Channel source: The channels and campaigns that brought these deals in.

Step 1.2: Validate The Data

Here’s where I realized I couldn’t just assume my CRM data was clean. It rarely is. I checked for:

- Missing fields: Are contact titles or company sizes missing?

- Duplicate entries: Ensure no contact/deal/company was counted twice.

- Inaccurate data: Are titles outdated or industries incorrectly tagged?

Why This Matters

- Understand success: Closed-won deals are your clearest indicator of what works.

- Avoid biases: Without clean, validated data, your analysis might mislead you.

- Set the stage: This step builds the foundation for the deeper analysis to come.

For me, this was about laying the groundwork. Without clean, validated data, I knew any analysis I did would be flawed. This step wasn’t glamorous, but it was essential. I thought of it like sharpening my tools before starting a project.

Step 2: Enrich Contact And Company Data Using Clay

The raw data from my CRM was a good starting point, but I knew it was incomplete. Enrichment became my secret weapon. It added the context I needed to turn static data into actionable insights.

- Contact-level insights: Titles, seniority, and departments provide clues about who requests demo and who drives decisions.

- Company-level insights: Employee range, industry, growth stage — context is everything.

- Deal metrics: Deal size, deal velocity, ACV, and renewal rates highlight performance.

- Channel effectiveness: Attribution data shows where leads are coming from—and what converts.

Why Enrichment Is Non-Negotiable For Market Segmentation

At this point, I imagine I don't have to sell you on the importance of quality data. Data and ABM tools have done enough education.

But if I have to sum it up, here's how I think about it:

Imagine trying to solve a jigsaw puzzle without knowing what the picture looks like.

Enrichment fills in the missing pieces so you can slice and dice your data anyway you want and ask pressing questions that help you scale.

Avoid Common Pitfalls

- Overloading With Data: Focus only on fields that add value to your analysis.

- Ignoring Data Gaps: If a significant number of entries lack key fields, fix it before proceeding.

When done right, enrichment transforms your CRM data into a living, breathing representation of your customer base. It sets you up to uncover patterns, tailor messaging, and prioritize efforts where they’ll have the most impact.

Step 3: Consolidate, Analyze, And Find Patterns

The real work begins here. By now, I had a treasure trove of enriched data. But without analysis, it was just noise. This step is about turning data into insights and insights into action.

Every good analysis starts with sharp questions.

Here’s how I dug deep.

- Contacts from which employee range often request a demo?

- This helps you understand which company range is most receptive to your marketing efforts

- What’s the employee range where we win most often?

- Employee range impacts needs, budget, and decision-making speed. Knowing this helps prioritize segments.

- Which channels deliver the most qualified leads?

- Not all channels are created equal. Identifying high-performers means optimizing spend and effort.

- What roles drive decisions?

- If Marketing Directors or RevOps Managers dominate your deals, focus your efforts on understanding their pain points.

- What industries consistently convert?

- If SaaS companies in EdTech are your bread and butter, refine your messaging for their specific challenges.

With the data organized and questions framed, patterns will begin to emerge:

- Are there clusters of deals within a specific employee range?

Example: Mid-sized companies (251-500 employees) with Marketing VPs often convert faster. - Do certain channels dominate?

Example: Organic inbound traffic leads to higher ACV deals from 251-500 employees companies compared to paid ads. - Is there a common narrative?

Example: Companies in Dental industries struggling with manual processes consistently see value in our automation features.

This was my “aha!” moment — the point where raw data becomes strategic insight.

Step 4: Repeat for Closed-Lost Deals

Closed-lost deals are the other side of the coin.

If contacts who requested a demo and closed-won deals showed what works, closed-lost deals reveal what doesn’t—and why.

This step is about revisiting Steps 1 and 2, but focusing on the deals that slipped through your fingers.

Step 4.1: Pull Closed-Lost Deals And Enrich The Data

Go into your CRM and pull every closed-lost deal. Ensure you gather the same fields as you did for closed-won:

- Contact details: Names, job titles, departments, and seniority levels.

- Company information: Employee count, industry, and location.

- Deal metrics: Deal amount, deal velocity, and ACV.

- Channel Source: The channels and campaigns that brought these leads in.

1. Create a property in your CRM and make it mandatory for your sales reps to enter why the deal was lost.

2. Instead of using a dropdown with most common reasons why you lose the deal, make the property a text field. This allows you to capture all the context on why you lost the deal.

Just like in Step 2, use tools like Clay to enrich these deals with:

- Contact details: Seniority, department, and decision-making authority.

- Company metrics: Industry, size, and growth stage.

Step 4.2: Analyze The Gaps

Now, dive into the data to uncover:

- Segments where you lose deals most often: Are there specific industries or employee ranges where conversion rates drop?

- Challenging personas: Are there certain roles or seniorities that consistently choose competitors?

- Channel inefficiencies: Are some channels generating leads that fail to convert at higher rates?

Step 5: Compare Closed-Won and Closed-Lost Data

Now it’s time to bring it all together.

I uncovered deeper truths about our sales process and refined our strategy by comparing the enriched datasets from Steps 3 and 4.

Look for patterns that reveal:

- Who’s requesting demos? Compare personas and segments that frequently request demos.

- Who’s converting? Identify if those demo requests turn into closed-won.

- Segments with friction: Pinpoint where demo-heavy segments fail to convert.

The goal is to identify which personas are converting the most, and the channels and campaigns they're coming from.

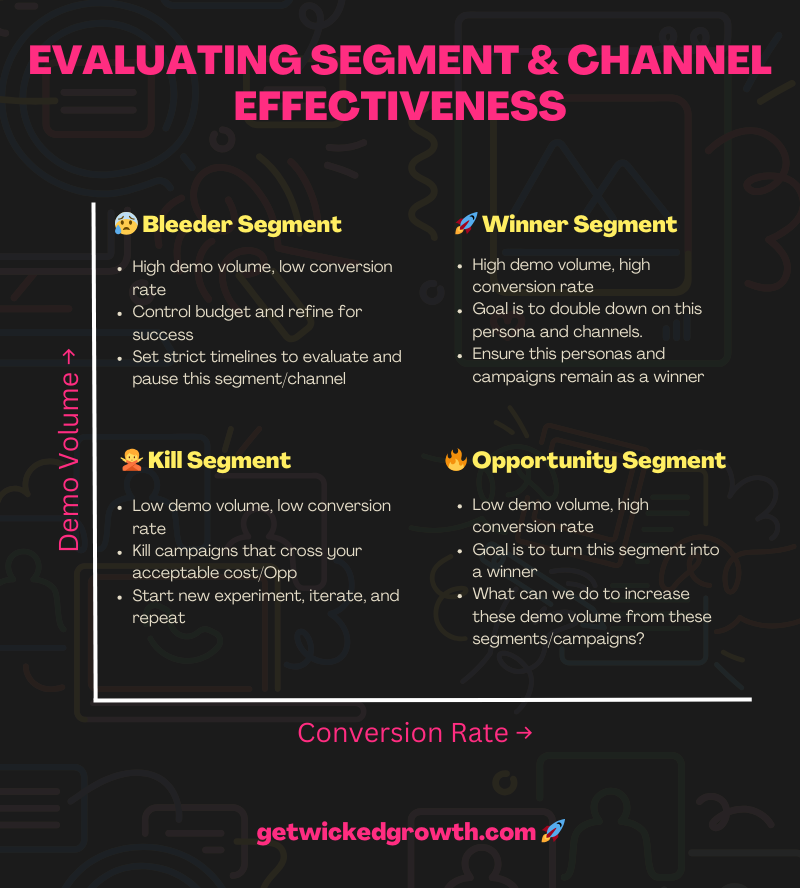

- High demo volume, low conversion: These segments are your bleeders. In first glance, they look like they're performing well. But when you dig deeper, you'll soon realize you may need better qualification or messaging adjustments.

- High demo volume, high conversion: These are the segments that are driving pipeline for you. You need to watch out for how well they're converting into customers. And keep an eye on how long they stick around without churning.

- Low demo volume, high conversion: These are your opportunities. They are already converting well. Now the question is, how do you scale them? Can you run targeted campaigns for these personas? Do you have the people, budget, and time to prioritize this segment?

- Low demo volume, low conversion: These are the segments and channels and campaigns you need to stop. You're wasting time, money, and energy by going after this segment.

Prioritizing Segments

Not all patterns are created equal. Your job is to focus on what moves the needle. This isn’t busywork—it’s strategy.

- Double down on winner segment: If mid-market SaaS companies dominate your wins, make them your primary ICP.

- Identify untapped potential: If an industry shows promise but low volume, experiment with targeted campaigns.

- Cut the noise: Eliminate segments, channels, or personas that aren’t delivering results.

- Identify weak spots: Understand where your pitch or product falls short.

- Spot red flags: Identify early indicators of deals that are likely to be lost.

- Improve targeting: Shift resources away from unproductive channels, personas, and company segments.

Final Thoughts

Niching down isn’t about exclusion. It’s about inclusion—focusing on the segments where you can provide the most value. This process requires effort, but the clarity and results it delivers make it worth every second.

The data is there. The patterns are waiting. So, who exactly are you selling to? The answer might just change everything.